Introduction

Informality is one of the major characteristics of developing economies. It is an especially important phenomen in the case of Latin America, where informality levels range between 30% and 70% of the total non-rural employment. According to the Economic Commission for Latin America and the Caribbean, ECLAC, informality levels in Latin American economies have been increasing from an estimated 57% of total non-rural employment in 1990 to 63.3% in 2005. The most recent data from 2009, given by the International Labor Organization (ILO), shows that Colombia presents one the highest levels of informality in the region (61.4% of non-rural employment), compared to Brazil (42.3%), Mexico (54.3%), and Argentina (50%). Given the relevance of this sector in the developing economies, the informal sector has become one of the most important topics in the research agenda of the developing countries. However, to understand how to reduce informality, we need to understand the motivation that makes workers decide to be informal and how governments can affect these decisions. In this way, even though this paper is theoretical it may help to understand how specific government policies may help to increase or reduce the level of informality in developing economies, such as Colombia. In other words, the theoretical findings of this paper can guide future empirical research on the impact of specific government policies on informality levels.

The paper aims to build a model that takes into account the informal labor market, typical of developing countries, using the search and matching framework. Such a model allowed me to analyze how three different policies, unemployment benefits, a formal lump sum tax, and a job creation subsidy, affect the levels of informality in the labor market. Through a search and matching model, I would like to answer three questions. First, how do workers decide to be employed in the formal or the informal sector? Second, what does equilibrium look like in economies with high levels of informality? Third, assuming the search effort is observed, how do the three policies that I have mentioned above affect the optimal decision of workers and the optimal decision of firms? To answer these questions I have set up a model that builds upon the work of Albrecht et al. (2009), where the informal sector consists of unregulated self-employment. However, unlike Albrecht et al. (2009), in my model, I allow for the transition of workers between the formal and the informal sectors.

Following Albrecht et al. (2009), I find that there are three type of workers in the economy, those with high productivity who work only in the formal sector, whom I call “pure formal workers”; those with low productivity who work only in the informal sector, whom I call “pure informal workers”; and those with medium productivity who remain in informal employment while searching for a formal job, whom I call “informal searchers”. Assuming the government can observe when a worker is formal or informal, I explore the impact of three different labor market policies on informality: unemployment benefits for those workers who are “pure formal”, a formal lump sum tax for those workers who are formally employed, and a job creation subsidy. I show that there is an equilibrium where the probability that a firm contacts a worker will depend on the composition of workers in the economy, i.e. the proportion between “pure formal workers” and “informal searchers” in the labor market. These policies affect the workers' incentives to join the formal or informal sectors, changing the composition of these two types of workers in the labor market (composition effect). In general, I show that an increase in the unemployment benefit for those who are “pure formals” increases the incentive for workers to become employed in the formal sector and reduces informal employment. An increase in the formal lump sum tax, on the other hand, increases the incentive for workers to become informal and reduces the level of formal employment. Finally, an increase in the job creation subsidy, also increases the number of formal jobs in the economy, reducing unemployment and informality. These results are complementary to those of Charlot, Malherbet and Ulus (2013) who found that a reasonable amount of unemployment compensation (UC) may reduce informality, given that informal employment acts as an unofficial insurance for workers.

Traditionally, the literature on labor informality has seen the informal sector as disadvantaged and segmented consisting of young and low-skilled workers that queue for better jobs in the formal sector.2 However, in more recent years, the empirical evidence from Latin American countries shows different patterns. Maloney (1999, 2004), argues that the labor market for unskilled workers may be well integrated with both the formal and the informal sectors. Both sectors offer desirable jobs with distinct characteristics for workers to choose from. From this perspective, the decision to work in the informal sector is voluntary. According to Maloney (1999, 2004), there are a couple of reasons why workers may chose the informal over the formal sector. First, the informal sector may be the best choice given the limited implementation of labor protection laws. A worker may prefer to evade payments such as social security contributions or taxes by working in the informal sector, given the low probability that he/she would receive any future benefits from them (imbalance between taxes vs. benefits, see kugler and kugler (2009, p. 336). The second reason why the informal sector might be a favorite choice is its flexibility in terms of work location and schedule, as well as the possibility for training, especially for young and inexperienced workers.

Looking at the employment in the informal sector as a voluntary choice implies, according to Maloney (2004), that: “Being in the informal sector is often the optimal decision [for workers] given their preferences, the constraints they face in terms of their level of human capital, and the level of formal sector labor productivity in the country” (p. 1160).

From this perspective, workers that chose to work in the informal sector would not necessarily be better off in the formal sector. To support this conclusion Maloney (2004) and Fiess, Fugazza and Maloney (2010)3 offered evidence for Mexico and Brazil where at least 60% of workers in the informal sector reported that they have entered the informal sector voluntarily. Amongst the main reasons they cited for choosing the informal sector were greater independence, flexibility and pay that the informal sector provided compared to the formal one. To support the argument that employment in the informal sector can be the optimal choice, Satchi and Temple (2009), used empirical data from Mexico to show that workers in the informal sector dedicated a small fraction of their time to looking for jobs in the formal sector, despite their continual mobility between the informal and formal sectors.4 In the case of Colombia, the evidence is less clear; in some cases, the decision to be informal seemed to be a voluntary choice, in other cases, the choice seemed to be due to a lack of better opportunities, even though, in general, informal workers did not perceive their occupation as being of lower quality (Bernal, 2009). Bernal also observed that although informal workers seemed to earn less than formal ones, this did not seem to be an important factor when deciding to leave a job in the informal sector. In short, there is considerable evidence that in developing countries such as Latin America, the decision to work in the informal sector is to a large extent voluntary, as many workers choose to work in the informal instead of the formal sector. Insofar as the decision to work in the informal rather than the formal sector being voluntary, it is possible to analyze the level of informality using the search and matching model.

My analysis contributes to the existing literature on informality in two ways. First, I extend the analysis of the informal sector in the search and matching framework. I build a model with formal and informal sectors, where workers in the formal sector are ex-ante heterogeneous. Following Albrecht et al. (2009), I assume that the informal sector consists of unregulated self-employment, and that there is no cost to be informal. However, unlike Albrecht et al. (2009), I allow for mobility between the informal and the formal labor sectors. This allows me to analyze the “composition effect” in the formal labor market. My second contribution is to analyze the effect of different policies in the labor market viewing informality as a voluntary decision, which I show to have different policy implications as compared to the traditional point of view of informality as a segmented market. Assuming the search effort is observed, I include three policies in my model: unemployment benefits for those who are “formal workers”, a formal lump sum tax for those who are formally employed and a job creation subsidy. I analyze how each of these policies affects the optimal decisions of workers and the optimal decisions of firms. Once I describe the equilibrium, I show how these three labor market policies affect the unemployment rate and the level of formal and informal employment. My results are in accordance with a number of findings in the literature. I find that a formal lump sum tax5 increases the incentive for workers to join the informal sector (as in Albrecht et al., 2009; Bosch, 2006; Boeri and Garibaldi, 2002; and Zenou, 2008; among others). However, my findings regarding the effects of unemployment benefits differ from those authors who view the informal sector as a segmented labor market. In my model I find that unemployment benefits increase incentives for workers to join the formal sector, therefore decreasing informality. These results are different to those of Zenou (2008), who finds that an increase of unemployment benefits decreases job creation in the formal sector and increases informality. However, he assumes that the decision to be informal is not voluntary, which is why the increase of unemployment benefits has a different impact on the labor market.

This paper is organized in six sections. In the first section, I present an overview of the most recent economic literature on informality. In the second section, I set up my model including different labor market policies and I describe the equilibrium solution. In the third section, I undertake a comparative analysis of each of the three policies that I have included in my model. In the fourth section, I carry out a numerical exercise that supports the comparative analysis conducted in the second section. Finally, in the last section, I summarize the main conclusions of this paper.

I. Literature Review

In recent years, many authors have focused their analysis on the effect of labor market policies on the formal and informal sector. The literature on informality in the labor market can be divided into three broad groups according to the perspective from which they study the informality. The first group analyzes the informal sector as a segmented labor market. The second group analyzes the informal sector as an illegal activity (from the point of view of firms) through which firms avoid paying taxes. Finally, a third group looks at the informal labor market as the outcome of an optimal decision from the perspective of the workers.

In general, the first group of studies models the informal sector as a segmented labor market. This is the case with Satchi and Temple (2009) as well as with Zenou (2008). In both cases, the informal sector is analyzed as a competitive market (without frictions) and the formal sector with matching frictions. Workers are assumed to be homogeneous and those who are in the informal sector queue for a formal job. Satchi and Temple (2009) analyzed a general equilibrium model with three sectors: urban formal, urban informal, and rural. They find that in equilibrium, if workers do not find any formal offers they can choose to work in the urban informal sector or work in the agricultural sector. In the model of Satchi and Temple (2009), workers in the informal sector queue for a job in the formal sector. According to them, the size of the informal sector has important implications for the aggregated productivity. From the same perspective Zenou (2008) also explores the implications of different policies such as unemployment benefits and employment subsides in the formal sector. He finds that reducing the unemployment benefit, or the entry cost of the firms in the formal sector reduces the size of the informal sector. However, he assumes that formal workers would always be better off being unemployed than working in the informal sector, which excludes voluntary transition from the formal to the informal sector.6 In general, in order to reduce informality, the major policy implication that views the informal sector as a segmented labor market is to reduce the cost of providing formal employment in the labor market.

A second group of researchers has analyzed informality in the labor market from the perspective of the firms, as a tax evasion activity that could be punished by the government. From this perspective, the tax evasion on part of firms constitutes the major drive towards informality. This is the case for Bosch (2006), Boeri and Garibaldi (2005), and Almeida and Carneiro (2011), among others.7 Bosch (2006) uses the framework of Mortensen and Pissarides (1994) to develop a model where firms choose to offer a formal or informal job, depending on the productivity of the match and the cost of formality. In addition, the informal jobs are monitored by the government, which destroys the match at a fixed exogenous rate. As a result, recessions or strict regulations increase informality. Similarly Boeri and Garibaldi (2005) present a model where shadow employment emerges in equilibrium as an endogenous response to high taxes and regulation. Moreover, Almeida and Carneiro (2011) and Marjit and Kar (2012) find that stricter enforcement increases formal employment and decreases informal employment. Thus, the major policy implications of this kind of perspective relate to the costs of formality and enforcement. In this respect, the perspective that looks at informality from the firm's perspective as a tax evasion policy, is similar to the first approach that views informality as a segmented labor market.

Finally, there is a third group of researchers that has viewed the informal sector as the outcome of a voluntary decision made by workers. This is the case with Amaral and Quintin (2006), Kugler and Kugler (2009), Albrecht et al. (2009), and Charlot et al. (2013), among others. Amaral and Quintin (2006) use a model with two sectors: formal and informal in a competitive labor market and with two types of workers: skilled and unskilled. Assuming that agents can self-finance part of their capital through savings or borrowing in the formal sector, they find that the most talented agents, operating with more physical capital, are self-selected into the formal sector, while the unskilled agents are more likely to be informal. Following the idea of informality as a voluntary decision by workers, Kugler and Kugler (2009) studied a model of efficiency wages, including non-wage costs when minimun wage is binding. They found that non-wage costs reduce formal employment when the tax burden is not completely shifted to workers via lower wages.

Other researchers in the third group, such as Albrecht et al. (2009) extended the search and matching model developed by Mortensen and Pissarides (1994) to include an informal sector and a continuum of heterogeneous workers. They characterized the informal sector as an unregulated self-employment sector. The workers' decision to be in the informal or formal sector is determined by their relative level of productivity in each sector. As a consequence, highly skilled workers are more likely to be found in the formal sector. The authors assume that all workers have the option to go informal, but the most productive ones find it more beneficial to work in the formal sector than the less productive workers. However, Albrecht et al. (2009) assume that there is no direct transition from the formal to the informal sector and vice versa. Furthermore, they analyze how a policy change, such as severance and payroll taxes can disqualify some workers from formal-sector employment, since under such policies workers would accept informal-sector offers that they would not have taken up otherwise.8 Following Albrecht et al. (2009), Charlot et al. (2013) use the search and matching framework to introduce the unemployment compensation (UC) policy in countries with high informality. They assume an economy with two sectors: the high-turnover sector and the low-turnover one. In each sector, a worker can decide to be formal or informal. Therefore differences in turnover rates induce differences in the incentives to go formal or informal. The authors focus on the impact of UC on the intrasectorial allocation of labor.

My work builds on the analysis of Albrecht et al. (2009). Therefore, it belongs to the third perspective that views employment in the informal labor sector as a voluntary decision. However, unlike Albrecht et al. (2009), and following Pissarides (2000), I allow informal workers to search for a formal offer. This means that I allow for the transition between the formal and the informal sectors. It is in this context that I analyze three different labor market policies: unemployment benefits, formal tax, and a job creation subsidy. My results support the findings of Charlot et al. (2013) who found that a reasonable amount of unemployment compensation (UC) may reduce informality.

II. Model

This analysis considers only the steady state, where time is continuous and workers are risk neutral with finite life. The assumption on risk neutrality implies that workers do not care about smoothing consumption and simply consume all their income in each period. Thus, workers maximize their expected utility by maximizing their income. The rate of death is given by an exogenous Poisson rate μ, which is also the rate at which new workers are born. In other words, the labor force in my model is constant and normalized to 1. The future is discounted at the exogenous rate r. The labor market frictions are modeled using a matching function, where search is random and wages are determined by Nash bargaining.

There are two sectors in my model; a formal and an informal sector. Workers in the formal sector are assumed to be ex-ante heterogeneous where their productivity level x is distributed according to the exogenous cdf H(x) with 0 ≤ x ≤ 1. When a worker is formally employed he will receive the wage w(x) which is a function of his/her productivity level x. Following Albrecht et al. (2009) I assume an informal sector that consists in unregulated self-employment, where there are no costs of being informal. All workers can decide to be informal or unemployed depending on their level of productivity. If a worker decides to be informal, he would receive an income flow w1, which is the same for all workers. If a worker decides to be unemployed, he will receive an income flow z, which represents the value of leisure. In this model, I assume that w1 > z. Once a worker is unemployed, he receives opportunities to work in the formal sector at an endogenous Poisson rate λ1 and when a worker is informal, he/she receives opportunities to work in the formal sector at an endogenous Poisson rate λ2, where λ1 > λ2 and λ1 and λ2 are endogenized using the matching function m (v,u e), where v refers to the number of vacancies and ue refers to the number of workers who effectively search for a formal job. The job destruction process is exogenous and is given only in the formal sector at the rate.δ

As I show in the following sections, this economy is characterized by three types of workers: Those with low productivity x < x1 who only work in the informal sector, whom I call “pure informal workers”. Those with medium productivity x1 ≤ x ≤ 2 who work in the informal sector and accept job offers from the formal sector, whom I call “informal searchers”, and finally those with high productivity x > x2 who prefer to be unemployed and only accept job offers from the formal sector, that I call “pure formal workers”. Let φ be the observed search effort of employed workers in the informal sector, where φ is 0 < φ < 1. Let us define Ni as the number of workers who are “pure informal workers”, Nis as the number of workers who are “informal searchers” and Nf as the number of workers who are “pure formal workers”, where uis denotes the fraction of “informal searchers” who are employed in the informal sector while searching for a formal job and uf denotes the fraction of “pure formal workers” who are unemployed. Then the number of effective workers searching for a job is given by ue = Nfuf + φ Nisuis where Nfuf refers to the total number of workers who are unemployed and searching full time for a formal job, and φNisuis refers to the number of workers who are informally employed searching for a formal job.

The matching process takes place between individual job vacancies and workers who search for a job. The number of job matches is given by a matching function: m(v,ue). I assume the matching function is increasing in v (number of vacancies) and ue, and that it is concave and homogeneous of degree one. The arrival rate of formal job offers when a worker is unemployed is given by:

Let  denote the tightness of the labor market. The arrival rate of getting a formal job when a worker is informal is given by λ2 = φλ1.

denote the tightness of the labor market. The arrival rate of getting a formal job when a worker is informal is given by λ2 = φλ1.

However, the arrival rate of filling a formal vacancy will depend on the number of workers searching for a formal job and the number of vacancies in the market. Then the arrival rate of filling a formal job offer is:9

In this model, I analyze three policies: unemployment benefits, b, formal tax, Tf and the job creation subsidy, s. Assuming the government can observe those workers who are formal and those who are informal,10 I consider the unemployment benefit for those who never take informal offers as an incentive for workers to join the formal sector. When working in the formal sector, workers should pay a formal tax, which for tractability I assume to be a lump sum tax. On the other hand, informal workers do not pay taxes but neither do they receive any benefits. Finally, I include a job creation subsidy as an incentive for firms to create jobs, s. According to Coles (2008), this policy can be interpreted as a capital investment subsidy.

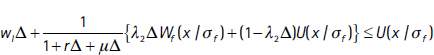

Let U(x) denote the value of being unemployed for a worker type x, Wf (x) the value of being formally employed for a worker type x and Wi (x) the value of being informally employed for a worker type x. The worker's value functions are given by:

Equation (3) implies that the opportunity cost of searching for a job while unemployed (or the return of being unemployed discounted by the interest rate r, and the death rate μ) is equal to the income flow z + b while unemployed, plus the capital gain attributable to searching for an acceptable job, Wf (x) − U(x), where an acceptable job implies that the value of being formally employed exceeds the value of continuing the search, Wf (x) > U(x) Equation (4) implies that the opportunity cost of being employed in the formal sector is equal to the current wage minus the formal tax, w(x) − Tf, plus the capital loss, max [U(x),Wi(x)] − Wf (x), attributable to the exogenous job destruction shock, which arrives at the rate δ. Finally, equation (5) implies that the opportunity cost of being informal and searching for a formal job is equal to the income flow wI while being informal, plus the capital gain attributable to searching for an acceptable job, Wf (x) > Wi(x).

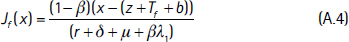

Let Ju denote the value of an unfilled formal vacancy and Jf (x) the value of a filled formal job with a worker type x, where c represents the cost of holding an unfilled formal vacancy and w(x) the wage, which depends on the worker's productivity.

Equation (6) implies that the return of holding a vacancy is equal to the capital gain when a firm fills the vacant job with a worker type x minus the net cost to post a vacancy (cost to post a vacancy minus the subsidy). A positive capital gain implies that the expected value of the filled vacancy exceeds the value of continuing to hold the unfilled vacancy EJf(x) > Ju. Equation (7) implies that the return of a filled job with a worker type x is equal to the output flow x minus the wage w(x), plus the capital loss attributable to the exogenous shock destruction δ and worker's death μ. The free entry condition for firms implies that Ju = 0.

When workers and firms meet the wage w(x) is determined by Nash bargaining, where β is the worker's bargaining power, and max{U(x),Wi(x)} and Ju are the threat points or disagreement's payoff. The Nash bargaining problem is given by:

The first order condition implies the following sharing rule:

where the total surplus of the match is defined as the worker's surplus plus the firm's surplus; i.e., S(x) = [Wf(x)–max{U(x),Wi(x)}] + [Jf (x)–Ju].

A. Worker's Strategy

First, I will describe the worker's strategy taking θ as given. To do this, I need to solve the bellman equations (3), (4), (5), (7) and the Nash bargaining equation (9). There are three cases I consider. Case A refers to those workers who never participate in the informal sector; I call them “pure formal workers”. This case implies that Wi(x) ≤ U(x) < Wf(x). Case B refers to those workers who prefer to remain informal while searching for a formal job offer; I call these workers “informal searchers”. In this case, U(x) < Wi (x) < Wf(x). Finally, case C refers to those workers who never participate in the formal sector, whom I call “pure informal workers”. Case C implies that U(x) ≤ Wf(x) < Wi(x).

Proposition 1. The optimal worker's strategy given θ is:

1) Workers with productivity x < x1 only work in the informal sector, “pure informal workers”, where:

2) Workers with productivity x1 ≤ x ≤ x2 (θ) keep working in the informal sector and accept job offers from the formal sector, “informal searchers”, where:

3) Workers with productivity x > x2 (θ) stay unemployed and accept job offers from the formal sector, “pure formal workers”.

Proof. See proof in Appendix 1.

B. Steady State Conditions

Assuming that the productivity distribution of the population is given by the exogenous cdf H(x), with total population normalized at 1, I can define Ni (θ) = H(x1) as the number of workers who are “pure informal workers”, Nis(θ) = H(x2(θ)) − H(x1) as the number of workers who are “informal searchers” and Nf (θ) = 1 − H(x2(θ)) as the number of workers who are “pure formal workers”. Using these definitions I can solve for the steady state number of “informal searchers” and “pure formal workers” given θ.

1. Steady State Conditions by Type of Workers Given θ

1) “informal searchers” with productivity x1 ≤ x ≤ x2 (θ)

Let uis denote the fraction of “informal searchers” who are employed in the informal sector while searching for a formal job; then the outflow from the informal sector equals the number of those who receive a formal offer: Nis(θ)uis φλ1 plus those who die, Nis (θ)uisμ. On the other hand, the inflow into the informal sector is given by those who lose their job in the formal sector: Nis (θ)(1-uis)δ, plus those who are born, Nis(θ)μ. In the steady state, the inflow and outflow from the informal sector should be equal, then:

2) “pure formal workers” with productivity x > x2 (θ)

Let uf denote the fraction of “pure formal workers” who are unemployed; then the outflow from unemployment is given by those who receive a formal offer: Nf(θ)ufλ1, plus those who die Nf(θ)ufμ. On the other hand, the inflow into unemployment is given by those who lose their job in the formal sector: Nf(θ)(1–uf)δ, plus those who are born: Nf(θ)μ. In the steady state, these two flows should be equal, hence:

Notice that in the steady state the rate of “informal searchers” who are employed in the informal sector while searching for a formal job, is higher than the rate of “pure formal workers” who are unemployed, uis > uf, given that φ < 1.

2. Steady State Probability Distribution Given θ

Let Gis(x) define the cumulative probability distribution for those “informal searchers” with x1 ≤ x ≤ x2(θ) given by:

and Gf(x) define the cumulative probability distribution for those “pure formal workers” with x > x2(θ) given by:

Let F(x′ / θ) define the cumulative probability distribution that a contacted worker has productivity x ≤ x’ conditional on θ Using the total number of workers who search effectively for a formal job, given by ue = Nfuf + φ Nisuis, and the distribution of workers' type defined in equation (14) and equation (15), I find F(x′ | θ).

Proposition 2. The cumulative probability that a contacted worker has productivity x ≤ x′ conditional on θ is given by:

For x’ ≤ x2(θ)

Assuming H(x) has a uniform distribution, I can show that for x’ ≤ x2(θ),  and for x > x2(θ),

and for x > x2(θ),  are constant probabilities. Moreover assuming φ < 1, I can show that K1 < k2 given that the following condition is satisfied: φ(δ + λ1 + μ) < (δ+ φλ1 + μ) Figure 1 represents the productivity distribution of a contacted worker.

are constant probabilities. Moreover assuming φ < 1, I can show that K1 < k2 given that the following condition is satisfied: φ(δ + λ1 + μ) < (δ+ φλ1 + μ) Figure 1 represents the productivity distribution of a contacted worker.

According to Pissarides (2000), there are two traditional externalities in the search and matching models. There is a negative externality which is created when firms enter the labor market, since they make it harder for other firms to find workers (congestion externality). There is also a positive externality, which is created when firms enter the labor market, since they increase the probability that workers find employment (thick market externality). In this model, I have an additional externality (composition externality). This externality refers to the fact that there are two types of workers in the labor market, the “informal searchers” and the “pure formals”, who use different search effort when searching for a formal job. This is reflected in the productivity distribution F(x′ / θ). Thus, given that the economy is characterized by two types of workers “formal searchers” and “pure formal workers” that search for a formal job with different search efforts, the search intensity in the economy is lower than the efficient one.11

C. Firm Strategy

The firm's strategy implies that the following three combined conditions should be satisfied: free entry condition, the firm's optimal decision and the worker's optimal decision given θ Equation (6) below describes the optimal behavior of a firm and using the free entry condition, Ju =0, the above condition can be re-written as:

Equation (16) expresses the optimal condition for a firm to post a vacancy, where the expected value of filling a vacancy, EJf (x), depends on the proportion of workers that search for a formal job given θ However, I already know that given θ, workers with productivity x ≥ x1 are willing to search for a formal job. Therefore, equation (16) can be written as:  Taking into account the productivity distribution of the workers that a firm will contact given by Proposition (2), I find the following results.

Taking into account the productivity distribution of the workers that a firm will contact given by Proposition (2), I find the following results.

Proposition 3. The optimal strategy for a firm to post a vacancy is given by:

D. Equilibrium

1. Definition

A market equilibrium is given by the value of  that satisfies the following three conditions:

that satisfies the following three conditions:

1) The worker's optimal strategy given by proposition (1),

2) The steady state conditions given by equation (12) and equation (13) and,

3) The firm's optimal strategy which is given by equation (17).

2. Existence

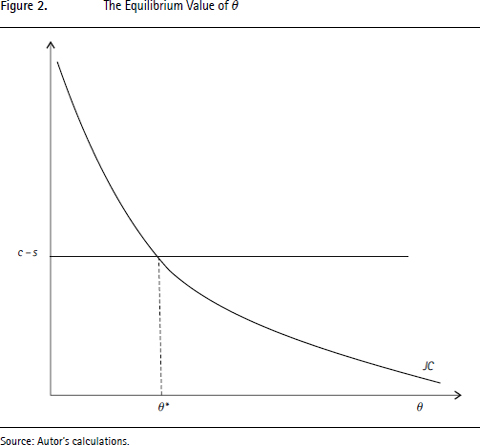

Using the above definition for market equilibrium, equation (17) determines the equilibrium value for θ Notice that the equilibrium exists if:

is a continuous function of θ Remember that F(x /θ) and x2(θ) depend on the matching function m(θ), which is increasing and continuous in θ This implies that both F(x / θ) and EJf (x) are continuous functions of θ. Moreover, assuming that  it is easy to show that

it is easy to show that  then by the intermediate-value theorem, there must exist a value

then by the intermediate-value theorem, there must exist a value  such that

such that  (see Figure 2).

(see Figure 2).

III. Comparative Statics

In this section, I analyze the effects of three labor market policies, unemployment benefits, a job creation subsidy and a formal lump sum tax, in the worker's and firms' decisions. I also explore the impact of these three policies in the labor market tightness. In this section, assuming that the government can observe when workers are “pure formals” or “informal searchers”, I show that the effect of an increase in the unemployment benefits for those who are “pure formals” increases the incentive for workers to become employed in the formal sector, which produces a positive “composition externality”. The effect on job creation, given an increase in the unemployment benefit, will depend on three effects: wage effect, “composition externality” and “congestion externality”. In general, the negative direct effect in wages more than compensates for the rest of the effects. Thus, job creation decreases, unemployment increases and informality decreases. An increase in the formal lump sum tax, on the other hand, increases the incentive for workers to become informal. In this case, the “composition externality” is negative. The effect on job creation given an increase in the formal lump sum tax will depend on the three effects: wage effect, “composition externality” and “congestion externality”. In general, the negative effect upon the wage more than compensates for the rest of the two effects. As a consequence, job creation decreases, and given that there are more “pure informal workers” in the economy, informality increases. Finally, an increase in the job creation subsidy s, does not imply any “composition externality”, “congestion externality”, or wage effect. However, it does imply an increase in the number of vacancies. As a consequence, “labor market tightness” increases and the level of unemployment and informality decreases. The numerical results of the next section confirm these conclusions.

A. Increasing the Unemployment Benefit b

Assuming θ as given, an increase in the unemployment benefit b has a negative effect on x2(θ), which given Nf(θ) = 1 − H(x2(θ), implies an increase in the number of workers who are “pure formals”.

Furthermore, as the number of “pure informal workers” does not change, the number of “informal searchers” decreases. Remember that Nis(θ) = H(x2(θ))–H(x1) then,  The reason for this result is because an increase in the unemployment benefit increases the incentive for workers to go formal and decreases the incentive for workers to go informal. Thus, for a given θ an increase in the unemployment benefit will change the composition of workers searching for a formal job, “composition externality”, increasing the effective number of workers searching for a formal job, (WS).

The reason for this result is because an increase in the unemployment benefit increases the incentive for workers to go formal and decreases the incentive for workers to go informal. Thus, for a given θ an increase in the unemployment benefit will change the composition of workers searching for a formal job, “composition externality”, increasing the effective number of workers searching for a formal job, (WS).

Assuming that the cdf H(x) is uniform, the probability to contact a worker of any type (“pure formal” or “informal searcher”) is lower than before the change in the policy. Given the increase in the effective number of workers searching for a formal job, this is the “congestion externality”. Figure 3 represents these results.

On the other hand, a change in the unemployment benefit affects the expected value of filling a vacancy, EJf (x). This change can be written as:

The first term of the RHS of equation (22) refers to the change in the expected value of filling a vacancy with a worker who is an “informal searcher”. Using the Leibniz's rule, I can express this term as:

Remember that  (see Appendix 2). Given that the probability of finding a worker of this type is low because of the “congestion externality” and on average the “informal searchers” are less productive than before the change in the policy given the “composition externality”, this term is expected to decrease. In equation (23), I show that the expected value of filling a vacancy with workers who are “informal searchers” decreases with an increase in the unemployment benefits.

(see Appendix 2). Given that the probability of finding a worker of this type is low because of the “congestion externality” and on average the “informal searchers” are less productive than before the change in the policy given the “composition externality”, this term is expected to decrease. In equation (23), I show that the expected value of filling a vacancy with workers who are “informal searchers” decreases with an increase in the unemployment benefits.

The second term of the RHS of equation (22), refers to the change in the expected value of filling a vacancy with a “pure formal worker”. As in the previous case using Leibniz's rule, I can express this term as:

In this case, there are three effects when unemployment benefit increases: the wage effect, the “composition externality” and the “congestion externality”. The first term in RHS of equation (24) refers to the direct effect on wages. An increase in the unemployment benefits increases the worker's reservation wage, which implies higher hiring wages (Pissarides, 2000). The other two effects are indirect, given by the “composition” and “congestion” externalities. The second term in RHS of equation (24) refers to the “congestion externality”. This effect is negative given that the probability to contact a “pure formal worker” is lower after the change in the policy The third term in RHS of equation (24) refers to the “composition externality”. This effect is positive given the increase in the number of “pure formal workers” searching for a formal job, which are more productive than the “informal searchers”,

The third term in RHS of equation (24) refers to the “composition externality”. This effect is positive given the increase in the number of “pure formal workers” searching for a formal job, which are more productive than the “informal searchers”,  Therefore, the total effect on the expected value of filling a vacancy with a “pure formal worker” is ambiguous and depends on which of these three effects is stronger. In general we can expect that the direct effect on wages more than compensate for the indirect effects.

Therefore, the total effect on the expected value of filling a vacancy with a “pure formal worker” is ambiguous and depends on which of these three effects is stronger. In general we can expect that the direct effect on wages more than compensate for the indirect effects.

If an increase in the unemployment benefits has a negative effect on the job creation  given by the direct effect in wages, the total number of vacancies will decrease and, as a result, the “labor market tightness” will decrease. However, given that there are fewer “informal workers” in the economy, the level of informality in the labor market will decrease. In fact in the numerical exercise that I carry out later in this paper I find that an increase in the unemployment benefits increases the unemployment rate, decreases the “labor market tightness” (as has been suggested by Pissarides, 2000 and Mortensen and Pissarides, 1999), and decreases informality.

given by the direct effect in wages, the total number of vacancies will decrease and, as a result, the “labor market tightness” will decrease. However, given that there are fewer “informal workers” in the economy, the level of informality in the labor market will decrease. In fact in the numerical exercise that I carry out later in this paper I find that an increase in the unemployment benefits increases the unemployment rate, decreases the “labor market tightness” (as has been suggested by Pissarides, 2000 and Mortensen and Pissarides, 1999), and decreases informality.

B. Increasing the Formal Tax Tf

As in the previous case, assuming θ as given, an increase in the formal lump sum tax Tf has a positive effect on x2(θ) and x1, which given Nf(θ = 1 − H(x2(θ)), implies a decrease in the number of “pure formal workers”. This also implies an increase in the number of “pure informal workers”, Ni (θ) = H(x1). Assuming the formal tax is a lump sum tax, I find that  which implies that the number of “informal searchers” does not change. Taking into account this result, for a given θ, an increase in the formal lump sum tax increases the incentive for workers to be “pure informal workers” and reduces the effective number of workers searching for a formal job, which means a negative “composition externality”:

which implies that the number of “informal searchers” does not change. Taking into account this result, for a given θ, an increase in the formal lump sum tax increases the incentive for workers to be “pure informal workers” and reduces the effective number of workers searching for a formal job, which means a negative “composition externality”:

Assuming that the cdf H(x) is uniform, the probability to contact a worker of any type (“informal searcher” or “pure formal”) is higher, given the decrease in the number of workers searching for a formal job, which implies a positive “congestion externality”. Figure 4 presents these results.

A change in the formal tax, on the other hand, affects the expected value of filling a vacancy, EJf (x), which implies:

The first term of the RHS of equation (26) refers to the change in the expected value of filling a vacancy with workers who are “informal searchers”. Using the Leibniz rule and assuming H(x) is a uniform distribution, I can express this term as:

Notice that  (See Appendix 2), as a consequence the expression in equation (27) is positive. Remember that the number of “informal searchers” does not change while the probability to meet them is higher than before the change in the policy, which means there is a a positive “congestion externality”. Moreover, on average these “informal searchers” are more productive than before the change in the policy (“composition externality”); hence, the expected value of filling a vacancy with “informal searchers” increases.

(See Appendix 2), as a consequence the expression in equation (27) is positive. Remember that the number of “informal searchers” does not change while the probability to meet them is higher than before the change in the policy, which means there is a a positive “congestion externality”. Moreover, on average these “informal searchers” are more productive than before the change in the policy (“composition externality”); hence, the expected value of filling a vacancy with “informal searchers” increases.

The second term of the RHS of equation (26) refers to the change in the expected value of filling a vacancy with “pure formal workers”, which can be expressed as:

In this case, there are two effects when the lump sum tax increases. The wage effect and the “congestion externality”. The first term refers to the direct effect in wages. This direct effect is negative given that in the bargaining process the formal lump sum tax is shared between workers and firms, which implies higher hiring wages. The second term refers to the “congestion externality”. This effect is positive given the increase in the probability of meeting such types of workers (“pure formal workers”). In this context, the net effect in the expected value of filling a vacancy with a “pure formal worker” can be positive or negative. In general, we can expect that the negative effect in wages will more than compensate for the “congestion externality” effect.

If the increase in the formal lump sum tax has a negative effect on job creation,  , given by the negative effect in wages, the total number of vacancies will decrease, (as reported in Pissarides, 2000).12 In this case, the “labor market tightness” will fall. However, given that there are more “pure informal workers” in the economy, the level of informality will increase. My numerical exercise in the next section corroborates that the effect on the “labor market tightness” is always negative, with an increase in the informality.

, given by the negative effect in wages, the total number of vacancies will decrease, (as reported in Pissarides, 2000).12 In this case, the “labor market tightness” will fall. However, given that there are more “pure informal workers” in the economy, the level of informality will increase. My numerical exercise in the next section corroborates that the effect on the “labor market tightness” is always negative, with an increase in the informality.

C. Increasing the Job Creation Subsidy s

As in the previous two policies, assuming θ as given, an increase in the job creation subsidy s does not affect the productivity level x2(θ) and x1 This implies that there are no “composition” or “congestion” externalities. Moreover, given that the job creation subsidy s does not affect the wage negotiation, there is no wage effect. Hence, the reduction in the cost of posting a vacancy increases the number of formal jobs in the economy. Given that the number of workers searching for a formal job does not change, the effect on the “labor market tightness” is always positive. Therefore, both the unemployment rate and the level of informality decrease (see Figure 5).

IV. Numerical Exercise

To find a numerical solution for the value of θ, I assume a uniform cdf for H(x) with 0 ≤ x ≤ 1 and a Cobb-Douglas matching function m(θ) = 4θ1/2. Moreover, assuming x2(θ) < 1 and x̄ = 1, I can solve the integral in equation (17) which implies:

To find a numerical solution for θ, I use the Newton-Raphson Method13 to solve non-linear equations.

The parameters have been chosen following the work of Albrecht et al. (2009), which allows us to approximate the numerical exercise (baseline economy), to the composite of several Latin American Economies as Argentina, Brazil, Colombia and Mexico. In this way, having a year as a unit of time, we set the value of leisure, z = 0 and the discounted real interest rate, r = 0.04. On average, according to the International Monetary Fund (IMF), the real interest rate (deposits rate) for these four countries in the last 10 years, have been around 3.6%. The job destruction rate and the workers' bargaining power are assumed to be equal to 0.5, to satisfy the Hosios condition (δ =β), Hosios (1990). The values for these two parameters are commonly set at this level in the literature ( see Mortensen and Pissarides (1999). Finally, the cost of posting a vacancy, c, is set to 0.3, which is higher than the one assumed by Albrecht et al. (2009) for the case of developing economies. The income flow in the informal sector, wi, is set to 0.2. These parameters allow us to find an average informal / formal wage ratio of 0.55, which is similar to the results reported by Patrap and Quintin (2006) for the case of Argentina. Finally, following Satchi and Temple (2009), we choose a low search effort φ= 0.1 which shows that workers in the informal sector spend a small fraction of their time looking for jobs in the formal sector.

These parameters reproduce a baseline economy, which represents the average Latin American economy with high unemployment rate (around 6%) and high informal employment (around 24%). For example, the unemployment rate of 6%, falls in the rank of 5% -10% which is the case for the unemployment rates for Argentina, Brazil, Colombia and Mexico. Moreover, the size of the informal employment is similar to the calibration models used by Patrap and Quentin (2006) (30%), but smaller than the baseline case reproduced by Albrecht et al. (2009) and Satchi and Temple (2009) (38%).14 Even though we set these parameters as the baseline case, we show the numerical results using different values for the following parameters: the cost of posting a vacancy, c, the income flow of being informal, wI, and the search effort of “informal searchers”, φ = 0.1 (see Table A3.1 from Appendix).

Table A3.1

Model with Different Parameters for c, wI and φ

Table 1 presents the results of the numerical solution including the three different policies: unemployment benefit (b) for “pure formal workers”, formal lump sum tax (Tf) for those who are formally employed, and a job creation subsidy (s), when the search effort for “informal searchers” is φ = 0.1. In the first column, I present the outcomes of the steady state equilibrium without any labor market policies (E5) in order to compare them with the steady state equilibrium outcomes in the presence of each of the three different policies. The second column (EP1) presents the equilibrium solution when there is an unemployment benefit for those who are “pure formal workers”. It is important to remember that in this case I am assuming that the search effort φ is observed, which means that informal workers are not eligible for unemployment benefits. Comparing this equilibrium solution with column E5, I find that the unemployment benefit increases the incentive for workers to join the formal sector (positive “composition externality”). As a consequence, informal employment decreases (ei = 22%), but given the increase in the number of “pure formal workers” in the economy, the unemployment rate increases (u = 0.07%), [similar results are found by Boeri and Garibaldi (2005) and Charlot et al. (2013). Moreover, the proportion of informally employed workers searching for a formal job decreases (e = 0.09). The last three rows in the second column (EP1) present the net output in the economy, the formal wages, and the Budget Balance with unemployment benefit policy. Then comparing the results in (EP1) with column (E5), the unemployment benefit policy increases the net output in the economy (Y = 0.44) and the formal wages (w = 0.38). Formal wages increase by the “composition effect” because “formal workers” are on average more productive after this policy. The budget balance is negative however, given that the benefits offered by the government are higher than the taxes collected.15

Table 1

Model with Different Labor Market Policies and φ = 0.1

The third column (EP2) presents the equilibrium solution when there is a lump sum tax Tf = 0.1 16 for those workers who are formally employed. Comparing these results with the equilibrium without the introduction of any policies E5, I find that a formal tax increases the incentive for workers to join the informal sector (negative “composition externality”). While the unemployment rate does not change, formal employment decreases to 61%. In addition, informal employment increases to 33%, and the proportion of informally employed workers searching for a formal job decreases to 11%. The net output suffers a slight decrease (θ = 0.41) as do the formal wages (w = 0.34) given by the negative “composition externality”. However, in this case, the budget balance is positive.

The fourth column (EP3) presents the equilibrium solution after the introduction of a subsidy for job creation. Compared to the equilibrium solution without any polices E5, a job creation subsidy reduces the cost of posting a vacancy, which increases the number of formal vacancies in the economy. This increases labor market tightness (θ = 2.59) and reduces the unemployment rate to 5%. Furthermore, informal employment decreases to 23%, while formal employment increases to 72%. As it is to be expected the net output in the economy and formal wages go up. The budget balance, however, remains negative.

The fifth column (EP4) presents the combination of two policies: unemployment benefit and formal tax. In this case, the labor market tightness decreases (θ = 1.23) as compared to the no policy equilibrium scenario (E5). The decrease in market tightness implies an increase in the unemployment rate to 7% and an increase in informal employment to 32%, along with a decrease in formal employment to 61%. Moreover, the proportion of informally employed workers searching for a formal job decreases to 6%. Notice that the net output increases (Y = 0.43), which implies that the positive effect from the unemployment benefit outweighs the negative effect from a formal lump sum tax. Furthermore, the formal wage does not change and the budget balance is positive compared to the scenario without policy.

The sixth column (EP5) presents the impact of two combined policies, the unemployment benefit and the job creation subsidy. In this case, the labor market tightness increases (θ = 2.13) compared to the no policy scenario (E5). Even though the unemployment rate does not change, there is an important reduction in informal employment to 22% and a reduction in the proportion of informal workers searching for a formal job to 7%. In this case, the net output is the highest in the economy (Y = 0.45). As can be expected, the budget balance is negative and formal wages increase.

The seventh column (EP6) presents the combination of formal taxation and a job creation subsidy. In this case, the labor market tightness increases (θ = 2.37) as compared to the no policy case in column E5. The unemployment rate decreases to 5%, but informal employment increases to 33%. Furthermore, the proportion of informal workers searching for a formal job decreases to 8%. The positive effect of the job creation subsidy cancels out the negative effect of the formal tax; as a consequence, the net output does not change. Moreover, the formal wage does not change and the budget balance is positive compared to the scenario without policy.

Finally the eighth column (EP7) presents the combination of all three policies: unemployment benefits, formal tax and a job creation subsidy. In this case, compared to the no policy equilibrium presented in column E5, I find that the labor market tightness increases (θ = 1.90). The unemployment rate does not change (u = 0.06), but informal employment increases to 31% and formal employment decreases to 63%. However, given that the proportion of informal workers searching for a job decreases (5%), the net effect of the three policies increases the net output in the economy (Y = 0.44). Finally, formal wages slightly increase and the budget balance is positive compared to the scenario without policy.

In sum, I find that the unemployment benefit increases workers' incentive to become formal workers. As a consequence, informal employment decreases and the unemployment rate increases. Moreover, the proportion of informally employed workers searching for a formal job decreases compared to the case without policies. The positive “composition externality” increases the net output in the economy and the formal wages. A formal lump sum tax Tf, increases the incentive for workers to join the informal sector. As a result, informal employment increases and the proportion of informally employed workers searching for a formal job decreases. The negative “composition externality” reduces the formal wages and the net output in the economy. Finally, a job creation subsidy s, reduces the unemployment rate and the informal employment in the economy, with an important increase in the net output and the formal wages. Furthermore, using a different combination of the three policies, I find that the proportion of those informally employed who are searching for a job always decreases and the net output and formal wages always increase compared to the case without policies E5.

Even though in this paper we do not study the minimum wage policy, it is easy to see what could be the effect of this type of policy in my model. Suppose we have a minimum wage which is set at wm ≤ x ≤ wI + Tf, remember that from the solution of our model, workers with productivity lower than x1 = wI + Tf, would prefer to be pure informal workers, and then those with productivity x > wm, would be informal searchers or pure informal workers. Thus, in this case, the minimum wage is not binding and the solution of the model is the same as before without policy. If we have a minimum wage wm > x1 (minimum wage is binding), then all workers with lower productivity who had previously chosen to be pure informal, would now prefer to be formal workers. However, remember that one of the most important assumptions of our model is that the wage is the result of Nash Bargaining, where there will be a match between firms and workers if there is positive surplus of the match. Hence, firms would not find it profitable to match with workers with productivity lower than x1. As a consequence, even though we impose a minimum wage, and given that workers with productivity x < x1 would prefer to work in the formal sector rather than in the informal one, these workers would never find a job. As a result, workers with low productivity x < x1 will always work in the informal sector. The workers with productivity between x1 < x < wm, that before the imposition of the minimum wage were a possible match, after the introduction of the minimun wage, will not be hired given that firms would not find it profitable to hire a worker with productivity lower than the minimum wage. In this case, the minimum wage, acts as a barrier to otherwise acceptable matches, which corresponds the standard negative employment effect using a competitive labour market framework (Flinn and Mabli, 2009). As a result, we will have a higher number of pure informal workers, those x < wm. In other words, in our model, the minimum wage policy would increase informality. Similar results are found for the case of Colombia, by Maloney and Núñez (2004) and Arango and Pachón (2014), who find that minimum wage reduced employment for those close to the minimum wage. Another interesting way to analyse the minimum wage is in the case where workers do not have any bargaining power, which may be the case of Latin American Economies. In this case, a minimum wage would stop firms taking all the surplus of the match. The study of this policy will require further assumptions that go beyond the scope of this paper.17

In general, my results corroborate those of other authors, such as Boeri and Garibaldi (2002) and Charlot et al. (2013), who find that an increase in unemployment benefits reduces informality while increasing unemployment. Other authors such as Zenou (2008) find that an increase of unemployment benefits decreases job creation in the formal sector and increases employment in the informal sector. However, this author assumes that workers are always better off in the formal sector, and as a consequence, there is no voluntary mobility from the formal sector to the informal one.

My results are similar to Albrecht et al. (2009)18 when they analyze the effect of a payroll tax (payed by the firms) on the level of formal and informal employment. In their analysis they find that a payroll tax reduces the rate at which workers find a formal job, increasing unemployment. Furthermore, the fraction of workers who would take a job in either the formal or the informal sector increases and, as a result, informality increases. Even though in my model I have a formal lump sum tax Tf, which is paid by the workers,19 my results are similar to Albrecht et al. (2009). I also find that the rate at which workers find a formal job decreases, given the decrease in θ, and the level of informality increases. However, unemployment does not increase given the decrease in the number of “pure formal workers” in the economy due to “composition externality”. Similar results are found in Boeri and Garibaldi (2005), Bosch (2006), and Zenou (2008)20 with an increase in unemployment. Finally, in the case of the job creation subsidy, I find the same results as those of Zenou (2008), who finds that job creation subsidy reduces the unemployment rate and the informal employment in the economy.

V. Conclusions

The steady state equilibrium solution in my model is similar to that provided by Albrecht et al. (2009). In both cases, those workers who have high productivity decide to be “pure formal workers” and those who have low productivity decide to be “pure informal workers”. However, in my model workers with medium productivity stay in the informal sector while searching for formal offers as “informal searchers”. Allowing “informal searchers” and “pure formal workers” to search for a formal job with different search efforts brings a new externality to the model: “composition externality”. In my model, I include three different policies, unemployment benefits for those workers who are “pure formal”, a formal tax for those workers who are formally employed, and a job creation subsidy. I show that there is an equilibrium where the probability that a firm contacts a worker will depend on the composition of “pure formal workers” and “informal searchers” in the formal labor market. Labor market policies affect the workers' incentives to join the formal or informal sectors, changing the composition of these two types of workers in the economy, which is called a “composition externality”.

In accordance with the majority of findings in the literature (Albrecht et al., 2009; Bosch, 2006; Boeri and Garibaldi, 2005, among others) I also find that a formal lump sum tax (similar to a payroll tax), increases the incentive for workers to become informal, which leads to a negative “composition effect”. As a result, formal employment decreases and informal employment increases. There is also a decrease in the proportion of workers informally employed who are searching for a formal job. Moreover, as is to be expected, a subsidy for job creation increases the number of vacancies in the economy, increasing the labor market tightness, and reducing the unemployment rate. Furthermore, as a consequence of a job creation subsidy, the informal employment decreases and the formal employment increase. As it is to be expected, the net output in the economy increases.

Finally, I find that the unemployment benefit increases the incentive for workers to become formal and, as a consequence, informal employment decreases but unemployment increases (given the increase in the number of “pure formal workers” in the economy, there is a positive “composition effect”). The proportion of informally employed workers searching for a formal job decreases. Furthermore, the unemployment benefit increases the net output in the economy.

It is important to emphasize that to be able to apply these policies, I am assuming that the search effort φ is observed, which, in general, is not the case. Nevertheless, the analysis of these labor market policies helps us to understand that informality in developing economies is also due to a lack of policies that aim to stimulate more workers to become formal. As reported by Kugler and Kugler (2009), there is no proper balance between the cost and benefit of being formal, on the contrary, given the lack of social protection, informal employment acts as an unofficial insurance for workers.21